Call (858)863-SOLD for your FREE consultation today. WE CAN HELP.

If you're frustrated, confused and looking for help to get out of foreclosure, you've come to the right place. The current housing market and financial crisis has caused an enormous amount of stress and heartache for families across America. If you or someone you know is among the millions today affected by the prospect of foreclosure, the first thing to understand is that YOU ARE NOT ALONE. Now more than ever, you need to find an advocate for you and your family's interests - someone who is specialized in helping out folks in your situation and prepared to handle your specific needs.

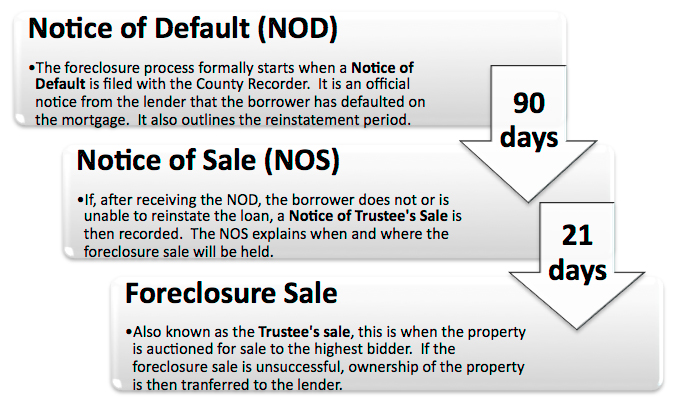

Foreclosure Timeline - what to expect:

The following timeline is applicable for non-judicial California foreclosures under a Deed of Trust.

There are no set number of payments to miss before the bank begins the foreclosure proceedings, but once you've missed several payments your Lender officially starts the foreclosure process by filing a Notice of Default with the County Recorder. The Notice of Default basically gives you 90 days to become current on your loan. If you are not current by the end of the 90 days, then a Notice of Trustee's Sale is then recorded. The Notice of Trustee's Sale gives you 21 days, at which point the property is sold at public auction to the highest third party bidder or reverts to the bank. The Department of Housing and Urban Development (HUD) provides an excellent resource on foreclosures, avoiding them and how the timelines work. Learn about it at http://www.hud.gov/foreclosure/index.cfm.

Avoiding Foreclosure - you have options:

The best way to avoid a foreclosure is by not waiting until the last minute to take action.

Refinance - If you are current with their your mortgage payments, you may be able to take advantage of today's mortgage rates and keep your home by refinancing to a 30- or 15-year fixed-rate loan via Home Affordable Refinance, a component of the Making Home Affordable initiative. For more information and eligibility criteria, visit the Making Home Affordable website: www.MakingHomeAffordable.gov.

Sell and Bring Cash to Closing - Although many homeowners today may not have the necessary cash to cure deficiencies at closing, you may be in the position to be able to liquidate assets to do so. By curing deficiencies at closing, you can avoid the credit damage that a short sale or foreclosure may cause.

Loan Modification - You may be able to work with your Lender to modify the original terms of your mortgage to make your monthly payments more affordable.

Forbearance - Forbearance is usually for temporary financial problems. You may be able to delay a foreclosure by working out a forbearance agreement with your Lender. Delaying the foreclosure allows you some time to catch up on your payments.

Deed in Lieu of Foreclosure - You may choose to voluntarily surrender your property to the Lender to stop the foreclosure process.

Short Sale - You can sell your home for less than what is owed. Your Lender may agree to accept less than the outstanding loan amount to satisfy your loan. This allows both you and your Lender to avoid foreclosure by selling the property at a loss.

If you are having difficulty making your mortgage payments or owe more than your home is worth, WE CAN HELP. VO Properties specializes in helping homeowners avoid foreclosure by selling their home through a short sale. We offer FREE no-cost, no-obligation consultations. Call (858)863-SOLD FREE today for any and all questions you may have. We may not be able to serve your every need, but if you need a professional for some other service, just ask! We've developed relationships with people who have proven themselves as some of the best experts in their professions.

Some or all of the options above have legal, tax and/or credit consequences. The information provided is meant for general informational purposes only and it is not to be construed as finance, tax, legal or credit advice. Please note that individual situations can vary and therefore, please consult your attorney, tax advisor or credit specialist for specific advice and counsel.